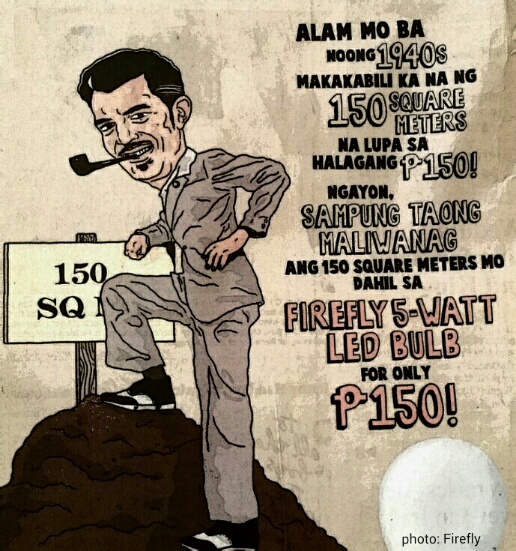

As I was reading the newspaper the other day (yes some people like me still read it), I saw this light bulb ad depicting how inflation has risen through time. To translate, it states that back in the 1940’s you can buy a 150sqm lot for only 150 pesos. Nowadays, your 150sqm lot will be lit for 10yrs because of this LED bulb for only 150 pesos. Funny as it is but it packs a big punch of reality. The purchasing power of a peso isn’t the same anymore.

I remember how my mom always told me to save my money in the bank. Back then, yeah I got it. The bank’s interest rates then was a sound investment that you can rely on. I guess the parents of this generation will be singing a different tune as your money invested in the bank will just die competing with the inflation rates. Still there is nothing wrong in putting your money in the bank. It’s the safest way every Juan knows and we all need liquid cash we can easily get 24/7 for emergencies. Nevertheless, other modes of saving and earning have risen. Some have been there ever since but we really never took the time to understand them.

As a Realtor®, I still believe that your hard earned money can reap great dividends in real estate if invested wisely. There are a lot of overpriced properties out there so I suggest that you also do your due diligence before purchasing a property. Asking for a licensed broker’s help can benefit you tremendously. Especially with the upcoming ASEAN integration, you have to be sure that all your investments and properties are solid and secure. Intense competition in business and workforce from other ASEAN countries can bring in good and bad results if we’re not competitive and ready. You can take advantage of this by making smart real estate decisions.

So better put on your thinking cap now and start anticipating the progress in our country. With the right investments you can stay ahead We live in a different generation now so don’t let yourself be left behind. It might be too late. May it be an investment in mutual funds, stocks, bonds, life insurance or real estate, keeping up with the times is important. Speculate then adjust where to put your money and you’ll be fine. Don’t hesitate to ask for help as this can mean more success for you in the future. So no matter how bloody inflation gets, just remember there is always a solution to counter it. You just have to do it right.

By: Peter Norrdell

If you enjoyed this blog post, share it with your family and friends! You may also follow us on Instagram @peternorrdell and Facebook @norrdellrealty for more real estate tips and updates.